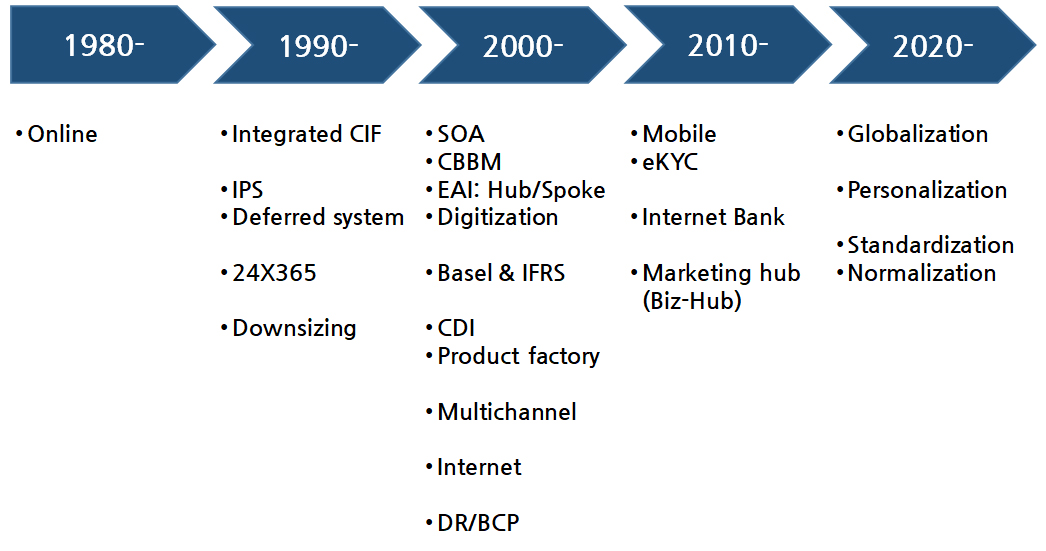

Key initiatives of banking system in Korea

Every 10 years, major banks has been rebuilding their banking system as big bang approach.

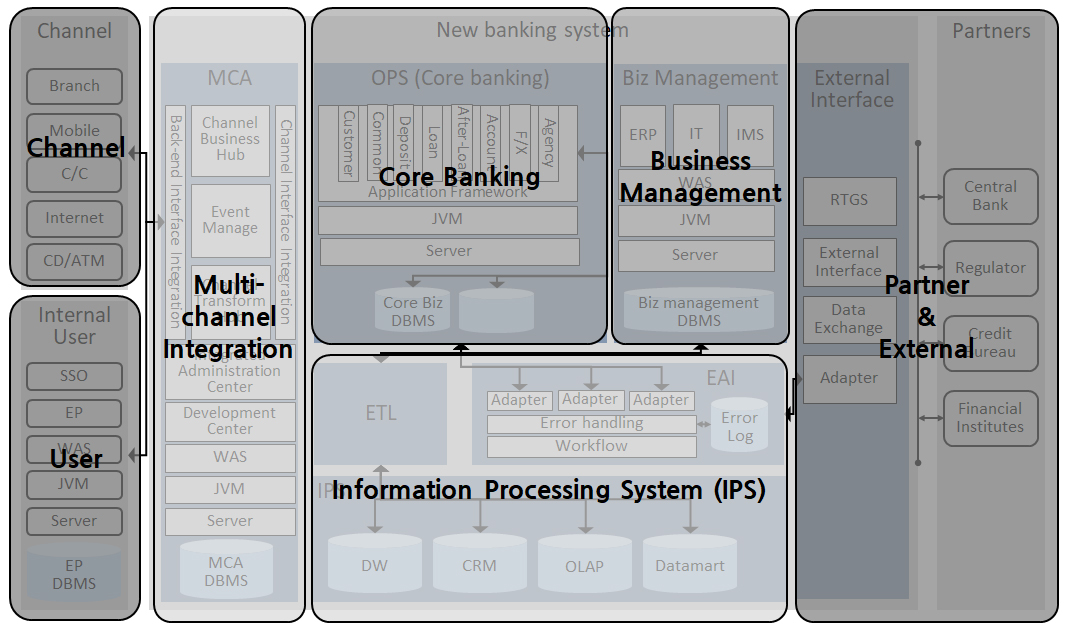

Traditional banking IT architecture

Banking system manages customer, product, and channel.

Digital banking service

- Converged smart service across industry through

- Mobile

- AI, Big Data,

- Biometrics, IoT…

- Innovations are required in three aspects of financial services.

- Consumption

- Provision

- Sympathy: customer-centric (technology benefit)

- Imagination: application point (pain point wow point)

- Implementation: prototyping first

- Type

- New banking services in Korea

- Frequent transfer

- Shared accoun

Understanding banks

For the moment, Banks in Vietnam have some pain points to go to the digital bank.

- Inappropriate for product management

- Difficult to build ecosystem for collaboration

- Not capable to manage credit risk

- Gap between IT and business due to lack of experience

- Needs to reduce the maintenance cost of IT infrastructure.

- According to Celent, the cost of maintaining ageing legacy banking systems eats up more than 75% of banks' IT budgets, leaving little for value-enhancing expenditure.

- Lack of money and resources

- Needs to reduce the risk of deploying new technology and business processes.

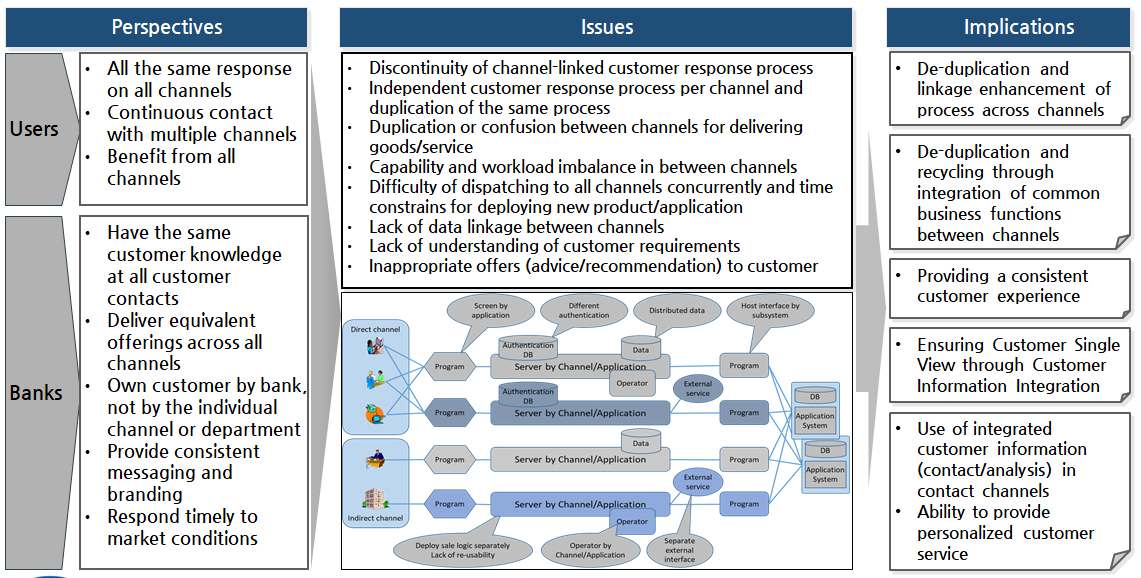

Understanding banks

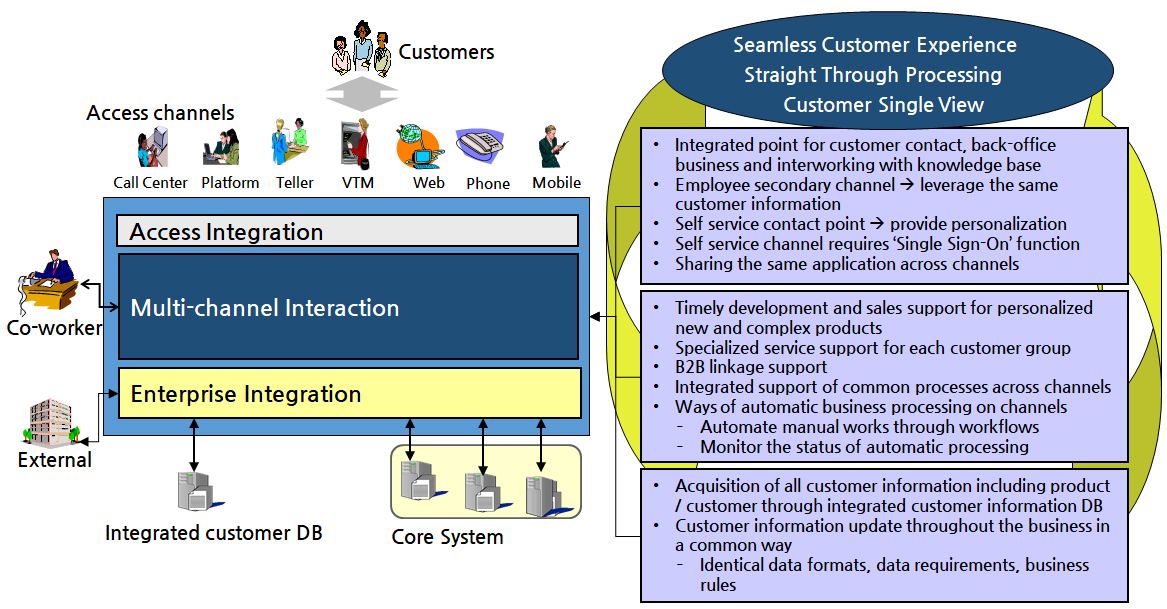

Financial institutions' channels have been promoting their own functions. Multi-channel integration, which has been carried out for the overall channel strategy, aims to enhance customer experience (customer relationship) and bank experience (operational efficiency) across all channels. It should provide timely response, consistent customer experience and secure single view.

Understanding banks

It is the future image that the customer is transformed into a system that has a consistent experience with the bank by consistently handling the customer's single view using the integrated information.

Understanding banks

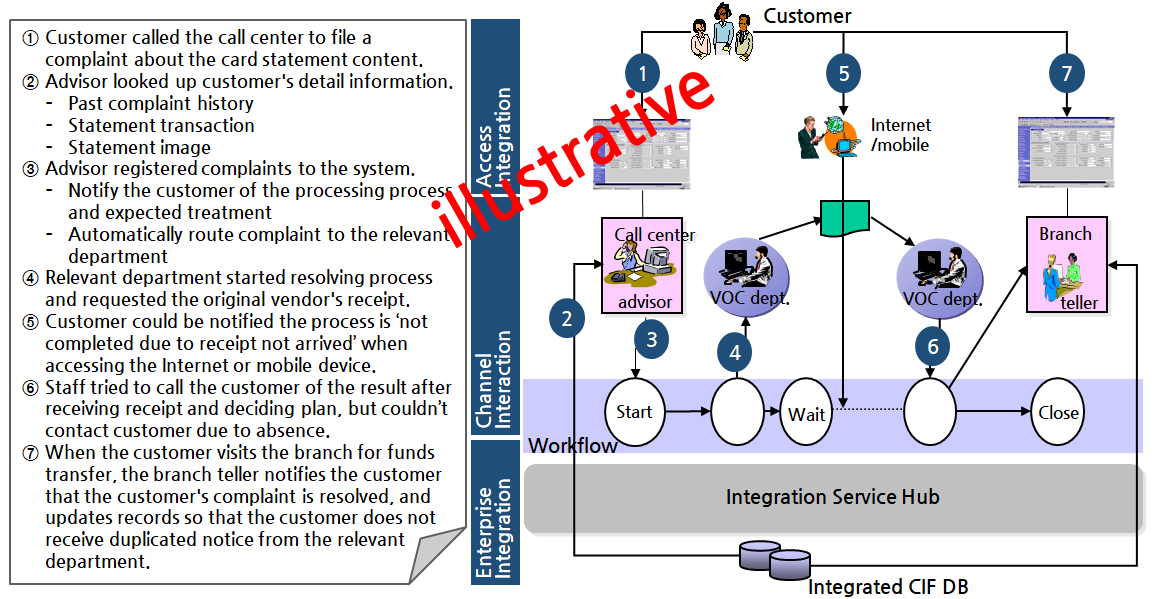

Multi-channel customer response scenario

Consistent and timely response to customer needs through the integration of multiple customer contact channels and customer information ensures a consistent customer experience.

Understanding banks

Multi-channel customer response scenario

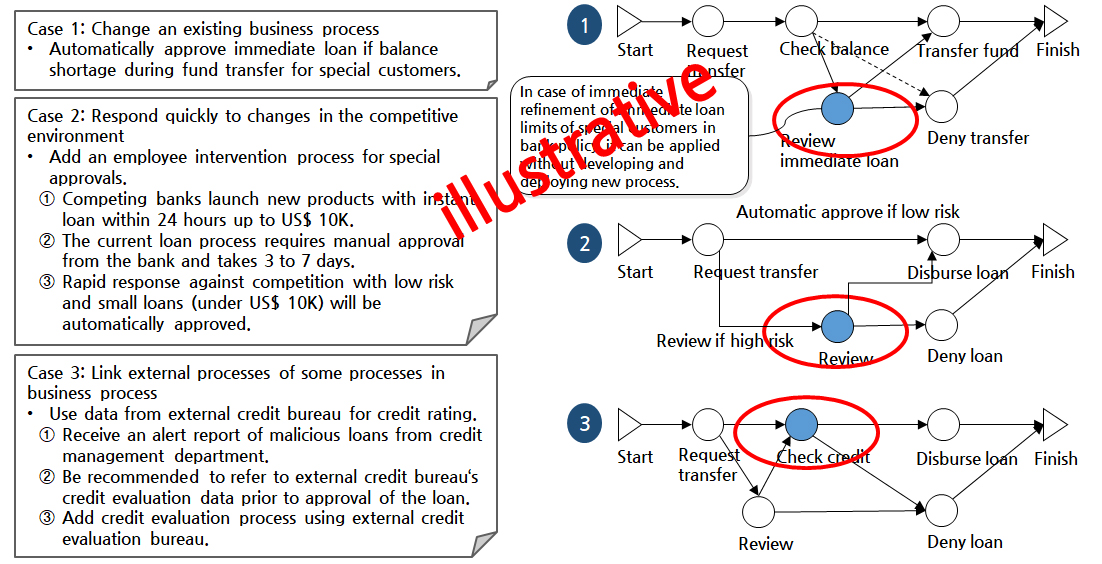

Personalized products and services can be delivered immediately, and even when changes are made to the business, they can be reflected without having to create new processes.

Multichannel innovations

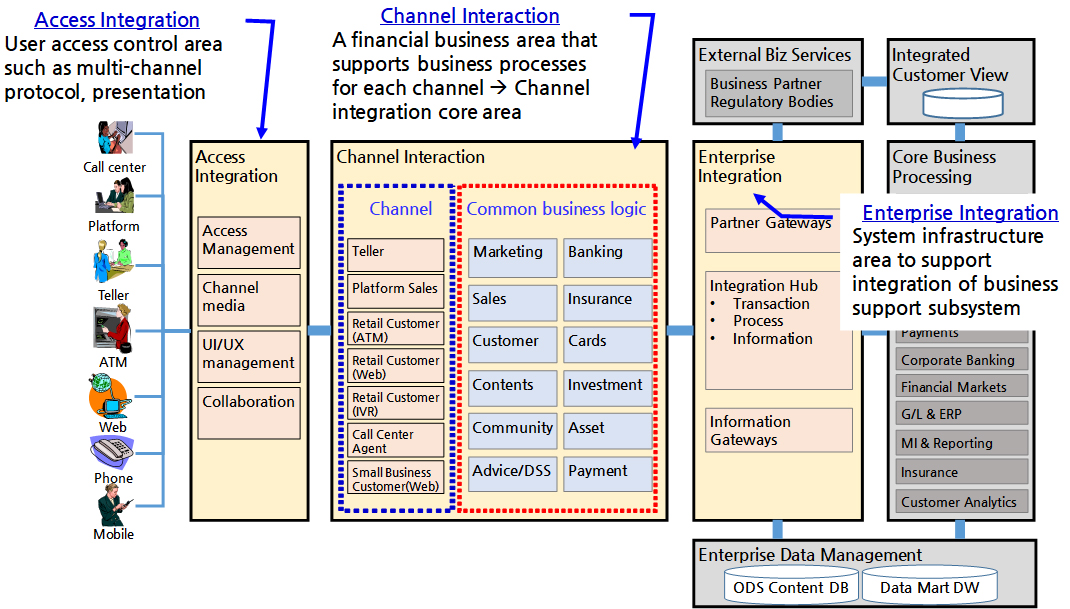

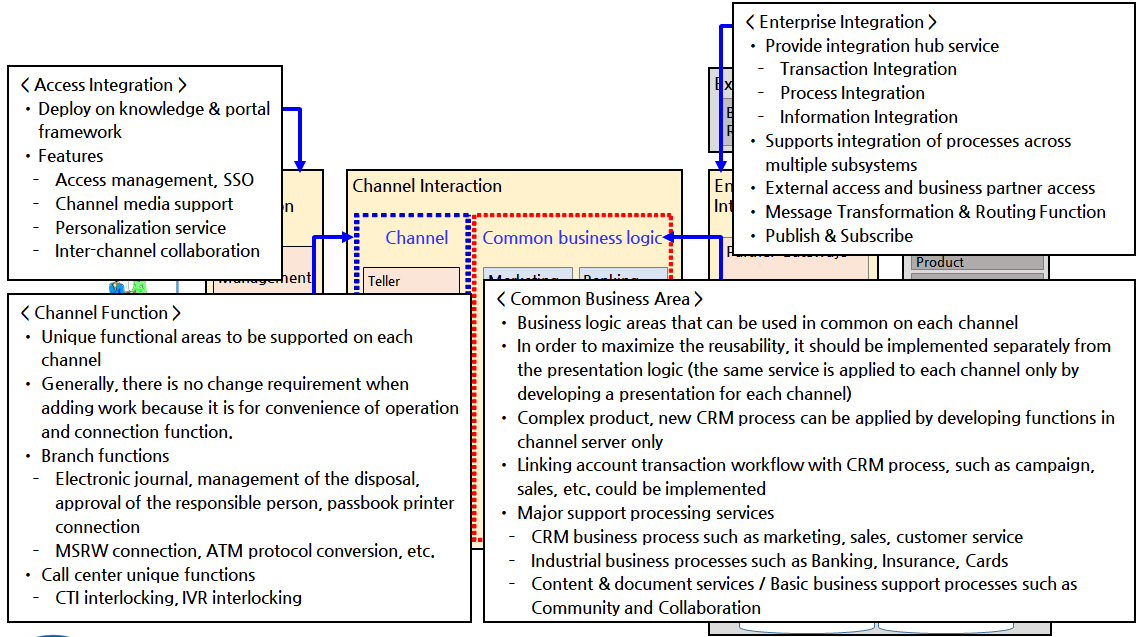

Multichannel innovation is an important area that efficiently handles common tasks and channel-specific tasks among the entire integrated solution architecture, and connects the customer contact channel with the back-end business system.

Multichannel innovation

Multichannel innovation consists of three layers. Effective design and recycling of 'common business logic' is a key part of strengthening bank competitiveness.

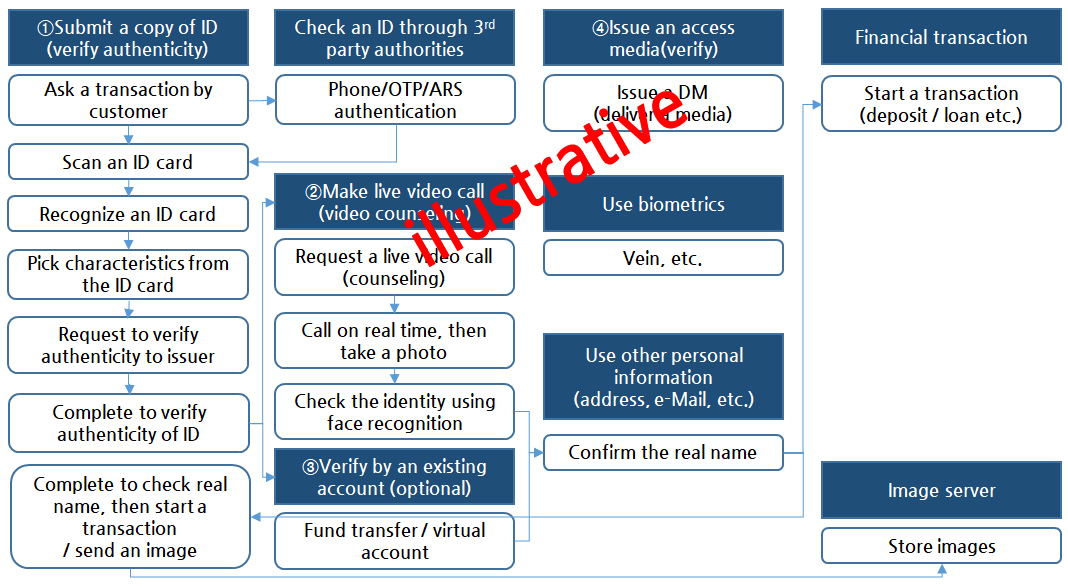

Key initiatives – NF2F authentication

There are various eKYC procedure.

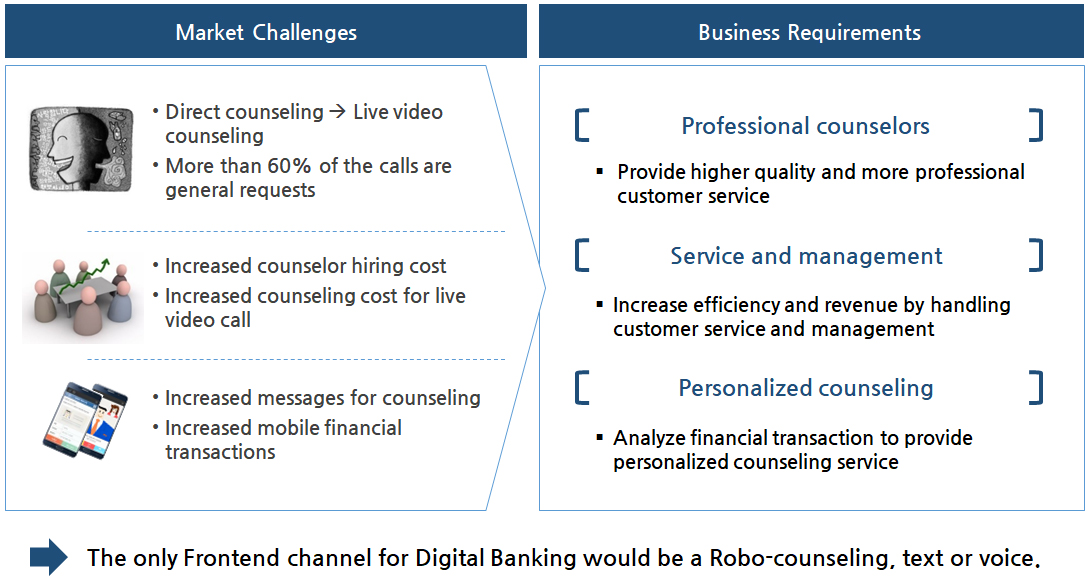

Key initiatives – Chatting robot

Requirements for unattended counseling and business processing are increased due to increasing mobile user.

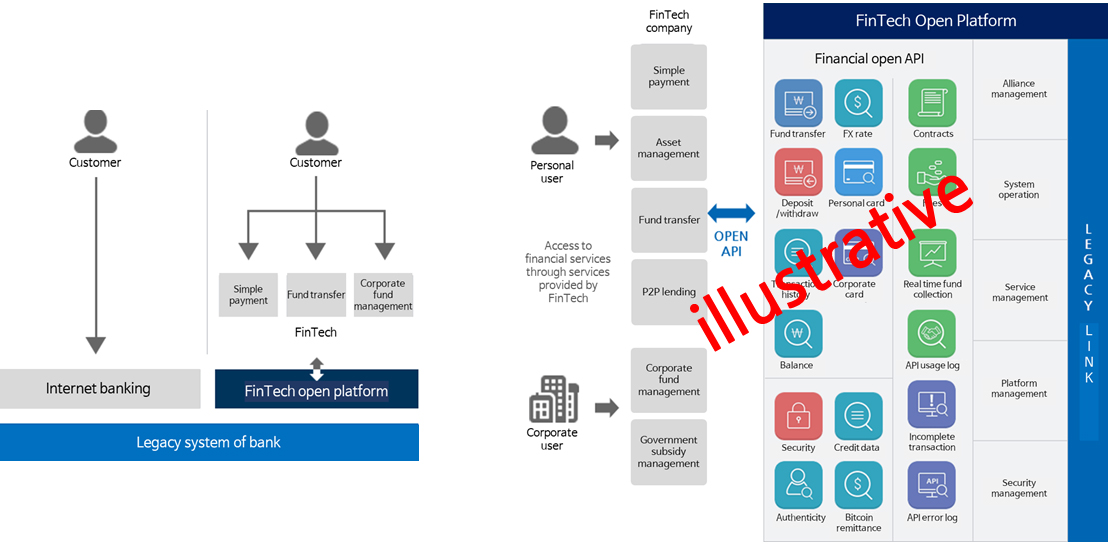

Key initiatives – Open API

It is not easy to meet the requirements of emerging services on legacy core-banking system on time. You need to build the open platform for banking service to provide various banking services through partners such as FinTech companies who are very elastic to meet customer requirement on time.

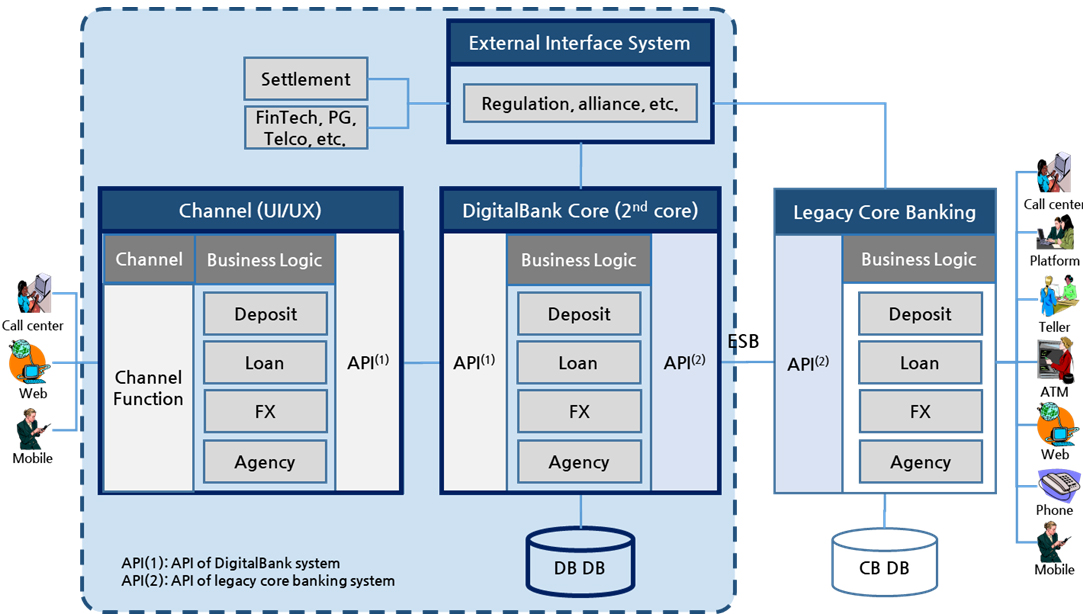

Key initiatives – 2nd core-banking system and channel system

The DigitalBank system would be developed on the 2nd core banking system and channel system to provide new services required for emerging customer requirements on time.

Core system structure

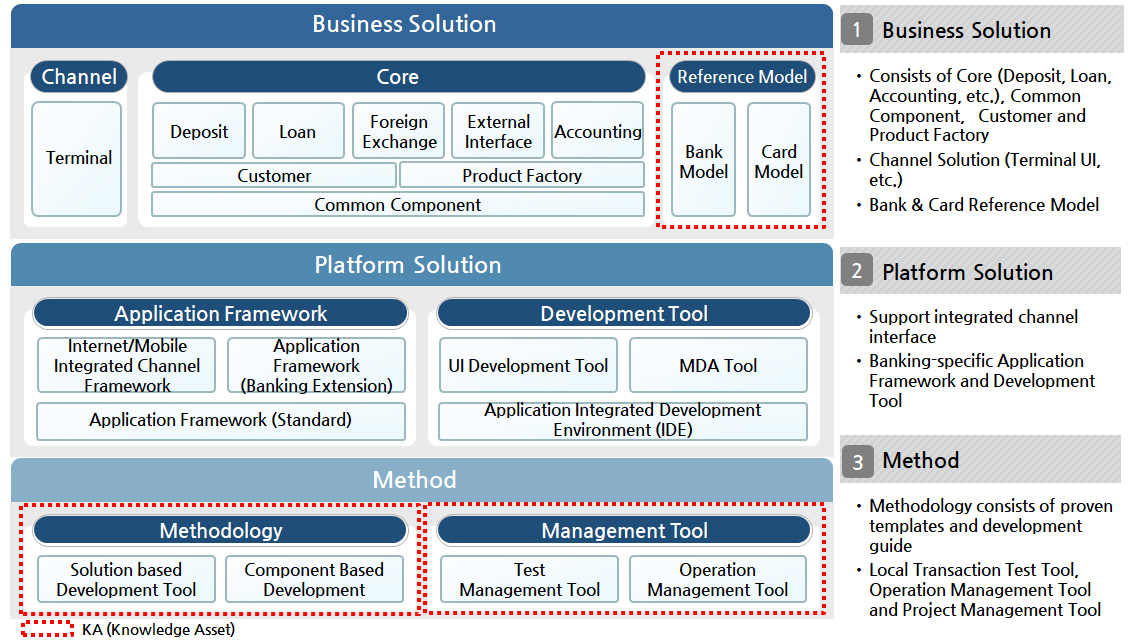

Based on various project experience, We have developed its proprietary core banking solution, which is consist of business solution and platform solution, and KA (Knowledge Asset).

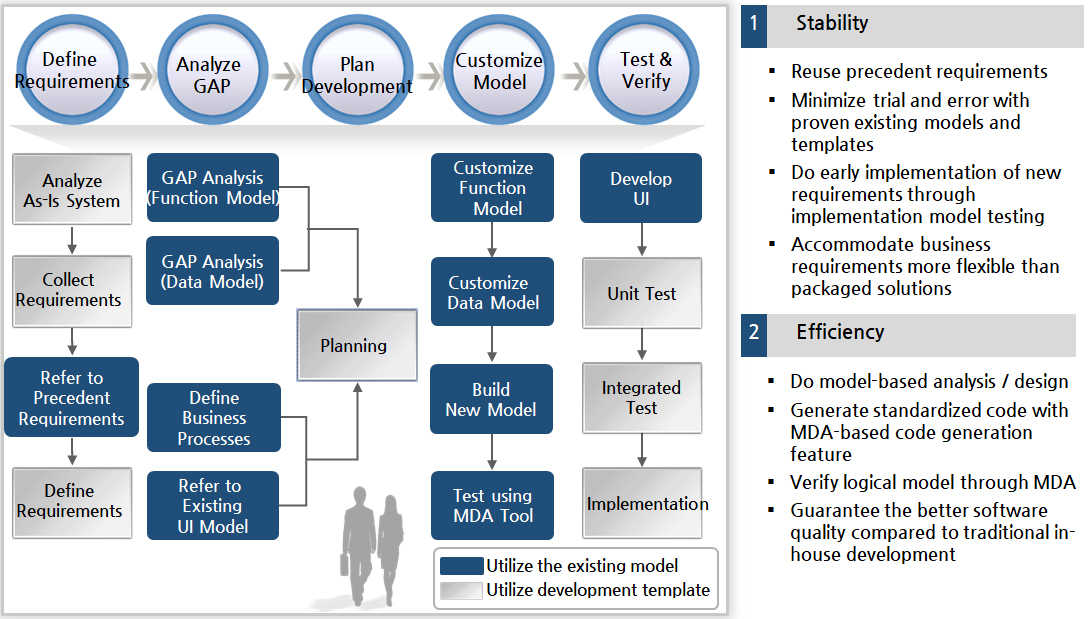

Development methodology

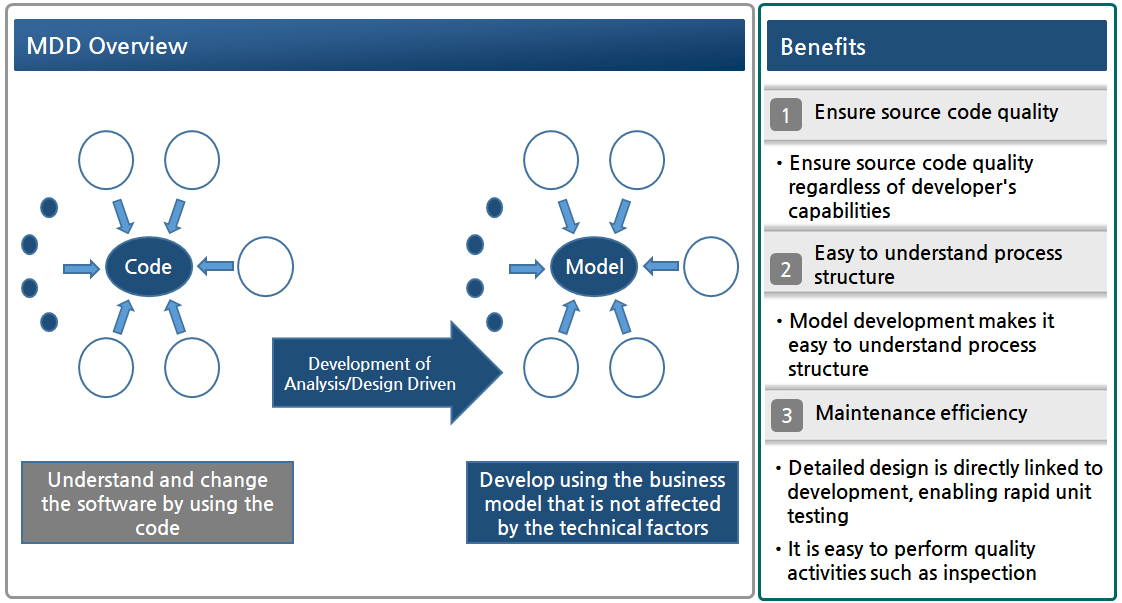

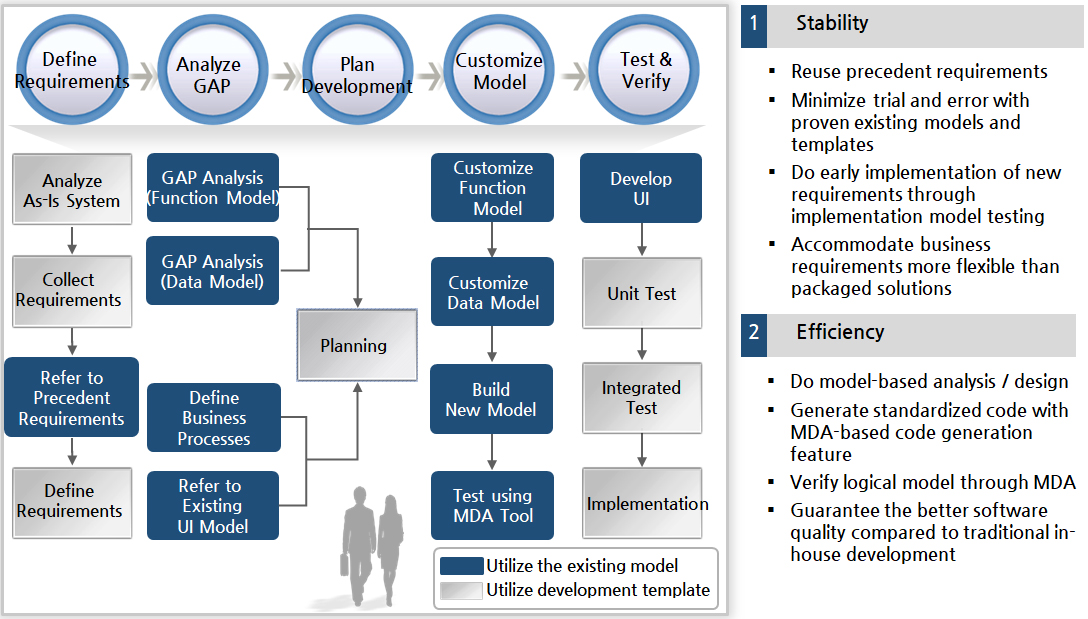

Model-Driven Development (MDD) is a design model-based development method that is reflected throughout SDLC. Compared to the traditional software development way, the MDD provides better software quality and productivity in developing and maintaining software.

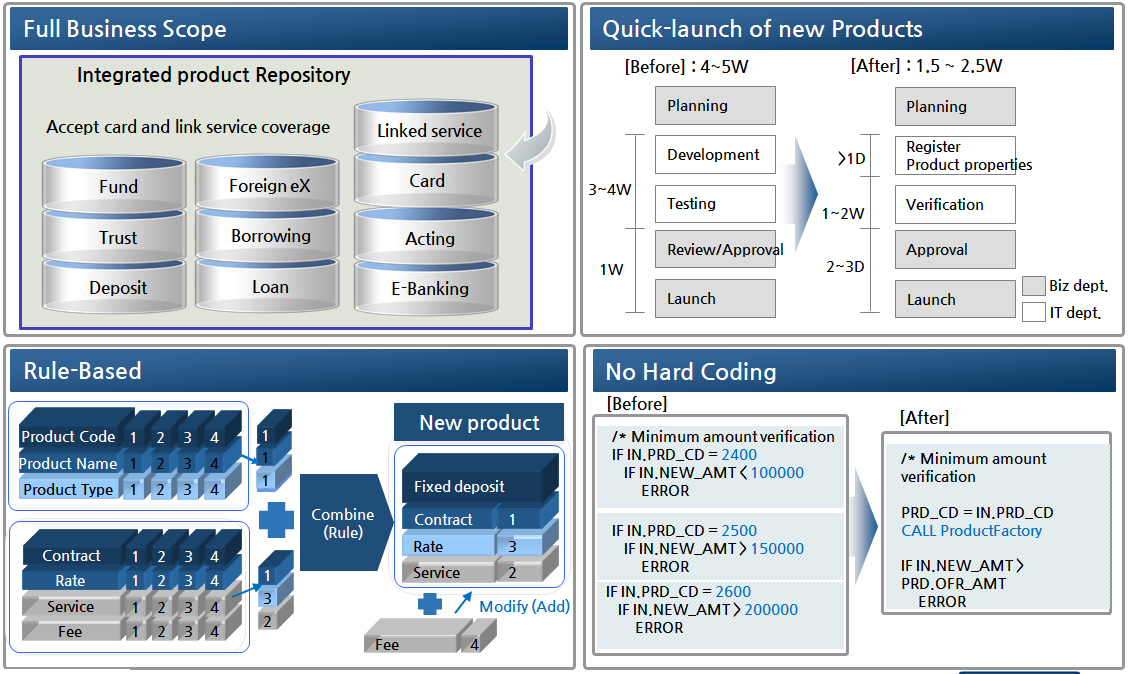

Product Factory

Product factory should be supported by a rule-engine, which enables fast product development.

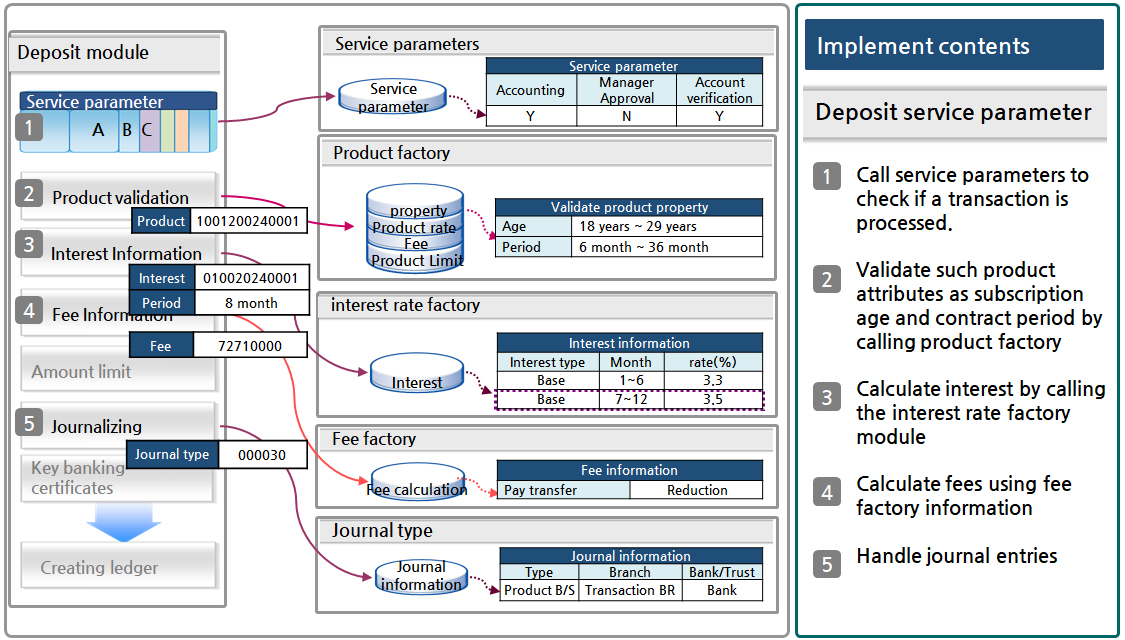

Parameter-based process configuration

Applications should be designed based on the parameter-driven approach. Then the configuration can be performed easily by changing properties rather than by modifying the application.

Approach for solution implementation

Solution model should be used on the analysis, design, development, and testing phases when building new banking system. It can help you minimize trial and error.

Phased approach

Solution model should be used on the analysis, design, development, and testing phases when building new banking system. It can help you minimize trial and error.